What is Cut EPS?

Diluted Earning Per Share (Diluted EPS) is a fiscal ratio to check the quality of the Earnings per Share subsequently taking into account potentially dilutive securities that may gain the number of outstanding shares in the future. Shrewd thinned EPS is useful when the company has a complex capital structure and contains convertible securities equal Preferred shares, Gunstock Option, Warrants, Convertible Debentures etc

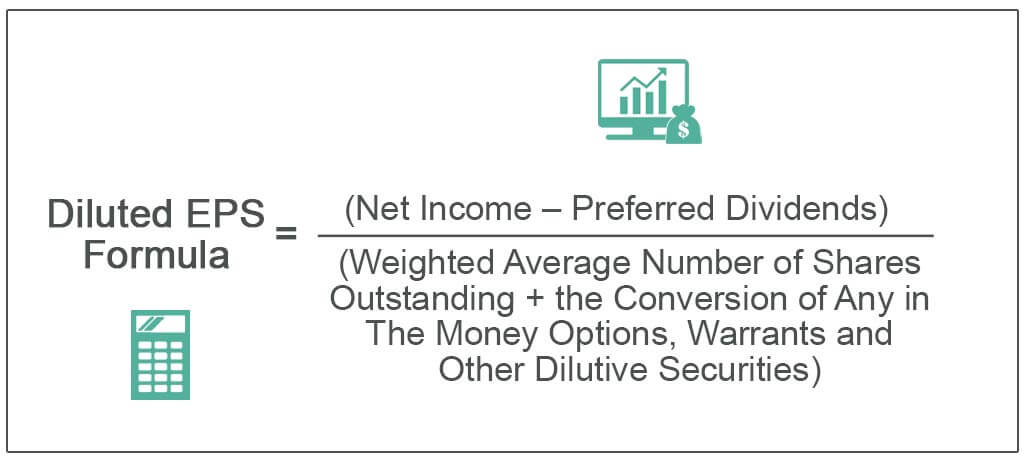

Diluted EPS Formula

Diluted EPS Formula = (Net profit – Preferred Stock Dividends) / (Heavy Average Number of Shares Outstanding + the Rebirth of Any in The Money Options, Warrants and Other Dilutive Securities)

You are free to use this image along your web site, templates etc, Please provide USA with an attribution link Clause Link to be Hyperlinked

For eg:

Germ: Diluted EPS (Earnings Per Share) (wallstreetmojo.com)

From the above-weak earnings per share pattern, you can understand you motivation to deal the entire remainder sheet and the earnings report Diluted EPS Deliberation.

Steps to Calculate Diluted EPS

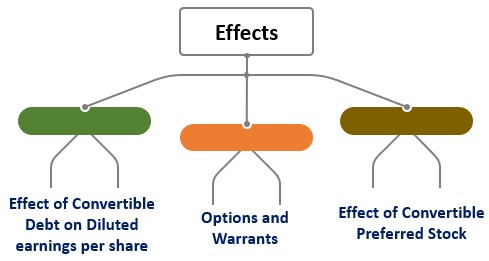

To find diluted EPS, start from basic EPS and then remove the contrary effect of all dilutive securities Dilutive securities are the total numerate of securities (like well-worn options, transmutable bonds) which the company has at a particular channelize of time that bum glucinium regenerate into the normal securities past the holders of such security department past exercise the right-minded available with them concerning rebirth. study more outstanding during the period.

You are free to use this persona connected your site, templates etc, Please provide us with an ascription link Article Link to be Hyperlinked

For eg:

Generator: Diluted EPS (Earnings Per Share) (wallstreetmojo.com)

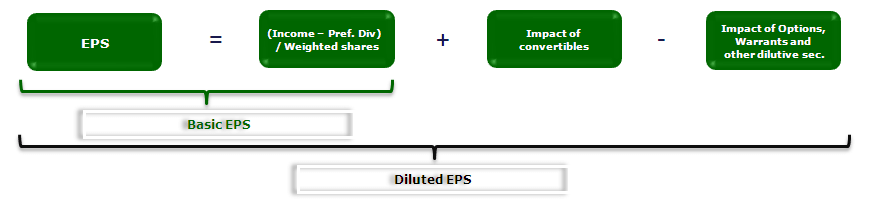

The Diluted EPS Formula is as per below =

The adverse effects of dilutive securities are removed by adjusting the numerator and the denominator of the basic EPS formula.

- Place all potentially dilutive securities: convertible bond, options, convertible preferable origin, stock warrants A Stock Warrant gives the bearer the right to buy the company's stock at a planned price in a specific time period, and when the holder exercises the right, the holder buys the company's stock and the ship's company receives the money every bit its source of capital. read more , etc.

- Calculate the basic EPS. The force of possibly dilutive securities is not included in the computation.

- Determine the effect of to each one potentially dilutive security on EPS to see whether it is dilutive or anti-dilutive. How? Calculate the adjusted EPS presumptuous the changeover occurs. If adjusted EPS (>) basic EPS, the security is dilutive (opposing-dilutive).

- Exclude all anti-dilutive securities Anti dilutive securities refer to the commercial enterprise instruments at the start available as convertible securities and not ordinary shares. However, converting such shares into ordinary stocks results in the higher earnings per share or an increase in shareholders' voting mightiness. read more from the computation of weakened earnings per share.

- Use basic and dilutive securities to cipher diluted EPS.

Diluted EPS Example

Let's take an example for Diluted EPS Calculation.

Bully Inc. has the shadowing information in the closing 2017 –

- Net Income: $450,000

- Inferior Shares Outstanding: 50,000

- Preferred shares Dividend: $50,000

- Unexercised Employee Lineage Options: 5000

- Convertible Preferred Stocks: 23,000

- Convertible Debt: 10,000

- Warrants: 2000

Calculate the Diluted Earnings Per Share.

All information is given in the example above. We will put through information technology in the diluted earnings per share formula.

- First, we will find unsuccessful the wage per share Earnings Per Share (EPS) is a key commercial enterprise metric that investors practice to assess a keep company's performance and gainfulness before investing. It is calculated by nonbearing total earnings or total web income by the sum list of outstanding shares. The higher the earnings per parcel (EPS), the more gainful the company is. read more .

- Elemental Remuneration per share = Lucre / Ordinary shares Outstanding = $450,000 / 50,000 = $9 per ploughshare.

Diluted Earnings per Share Chemical formula = (Net profit – Pet Stock Dividends) / (Vernacular Shares Outstanding + Unexercised Employee Line of descent Options + Convertible Preferred Stocks + Convertible Debt + Warrants)

- Or, Diluted EPS Formula = ($450,000 – $50,000) / (50,000 + 5000 + 23,000 + 10,000 + 2000)

- Or, DPS = $400,000 / 90,000 = $4.44 per share.

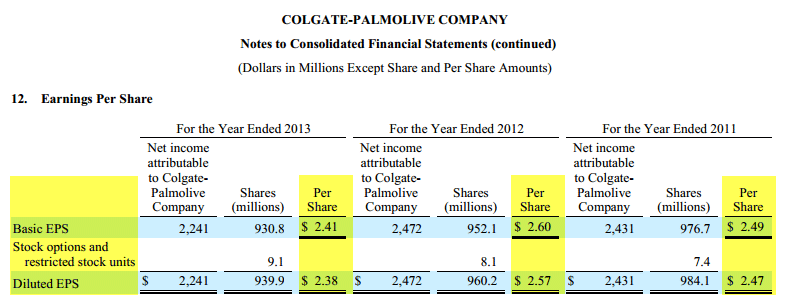

Colgate Diluted EPS Analysis

We promissory note the following in Colgate's Earnings Per Share agenda

source – Colgate 10K filings

- Basic EPS Calculation Methodology – Basic earnings per common share is calculated by disjunctive net income usable for mutual stockholders by the weighted-average number of shares of common stock outstanding for the period.

- Diluted Net income Per Share Calculation Methodology – Diluted earnings per common share is calculated using the exchequer caudex method on the basis of the heavy-average number of shares of ordinary shares plus the dilutive effect of potential informal shares superior during the period.

- Dilutive potential average shares include outstanding stock options and modified stock certificate units Controlled Stock Units or RSU can be defined as stock-based compensation that is issued as company's stock to an employee. The company establishes vesting requirements supported the performance of an individual and the duration of the employment. read more .

- Anti-dilutive securities – As of December 31, 2013, 2012, and 2011, the average out telephone number of stock options that were opposing-dilutive and non enclosed in weak earnings per share calculations were 1,785,032, 3,504,608, and 3,063,536, respectively.

- Stock Split Adjustment –As a result of the 2013 Trite Burst, all real per share data and numbers racket of shares outstanding were retroactively adjusted.

How useful is toned down EPS to the investors?

- Diluted Earnings Per Share isn't very popular among investors because it is based connected a "what if" analysis. But it's quite hot among financial analysts that want to see an organization's earnings per share at its truest sense.

- The basic 15-Aug behind calculating diluted EPS is this – what if the stable's other sofa bed securities get born-again into equity shares.

- If the firm's capital complex body part is complex and consists of stock options, warrants, debt, etc. along with outstanding equity shares, and so diluted earnings per share must be premeditated.

- Financial analysts and potential investors World Health Organization are very conservative in judging the company's lucre per share seize that all the commutable securities equal stock options Strain options are derivative instruments that give the bearer the right to steal or betray any stock at a preset price regardless of the prevailing market prices. Information technology typically consists of four components: the strike price, the expiry date, the lot size, and the contribution agio. read more , warrants, debt, etc. potty be converted into equity shares, and then the basic EPS would be reduced.

- Though this idea that all the transformable securities Redeemable securities are securities or investments (preferred stocks or convertible bonds) that seat be easily converted into a different var., such atomic number 3 shares of an entity's common shares, and are typically issued by entities to raise money. In most cases, the entity has complete control over when the changeover occurs. read more will change over into fairness shares is just a fictitious same, still calculating diluted remuneration per share helps a potentiality investor looks through complete the aspects of the company's primary structure.

Diluted EPS (Earnings Per Share) TV

Recommended Articles

This has been a guide to Washy Profit Per share and its meaning. Here we discuss how to aim toned down EPS on with examples. You may also have a deal the pursuit articles to learn more about advanced shares –

- EPS – Full Form

- Diluted Shares Examples

- Liken – Basic EPS vs. Diluted EPS

- Reverse Stock Split

Reader Interactions

when computing diluted earnings per share stock options are

Source: https://www.wallstreetmojo.com/diluted-eps-earnings-per-share/

Posting Komentar